Context:

Let’s be honest: valuations are fickle. They rise and fall with whatever narrative is hot that quarter. What doesn’t change? Actual, durable net income.

If you can get yourself to a place where you’re convinced your company can do a few hundred million in net income (or free cash flow, pick your poison), you’ll be fine. I’m not joking, this is a critical exercise for experienced founders, and it’s one that’s too often skipped.

Market Signal:

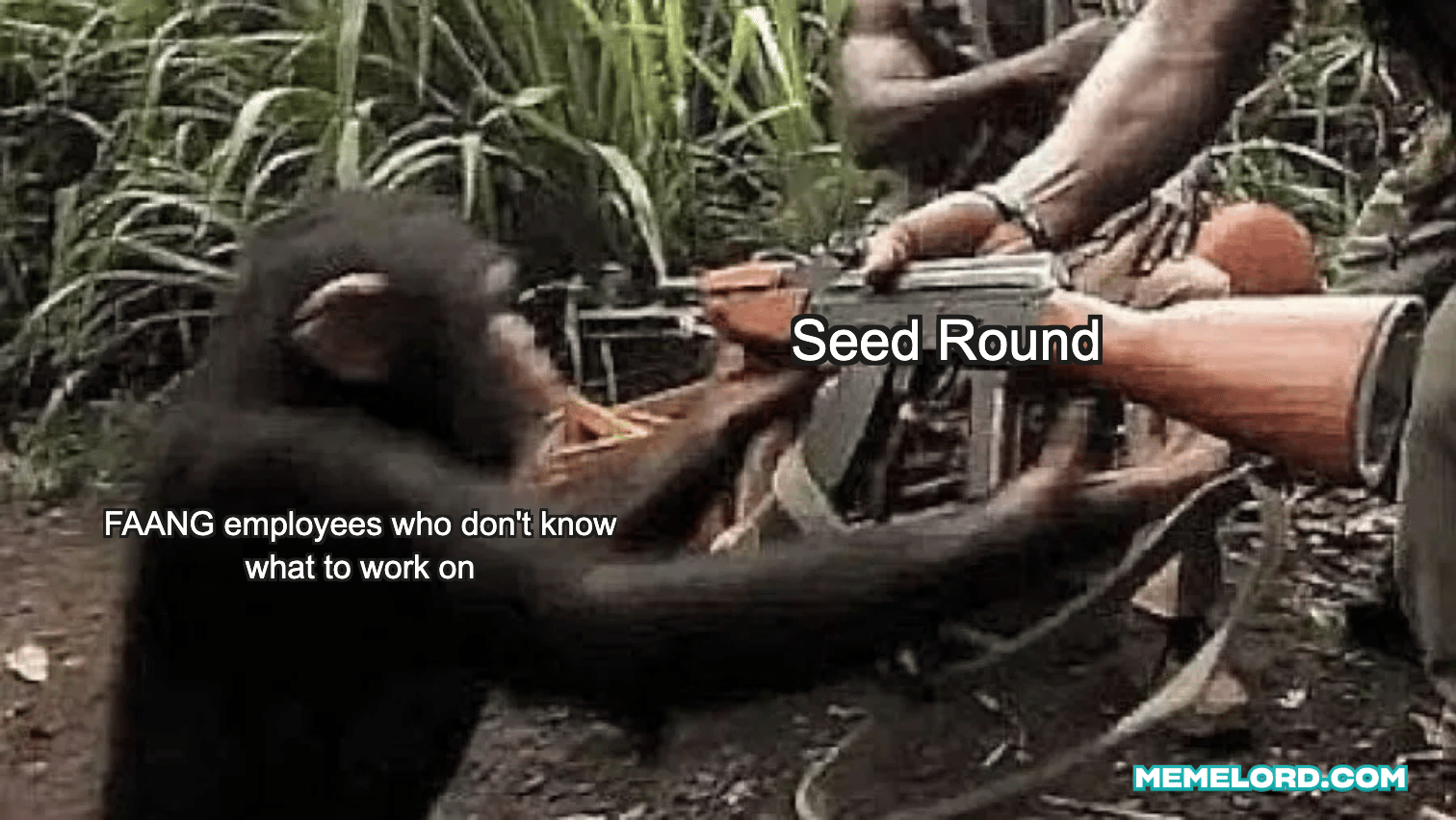

There’s a lot of noise in the market right now—hot rounds, frothy multiples, “move fast” energy everywhere. But the real signal? The founders who take their time, develop deep conviction, and only then commit. We’re seeing more experienced operators and repeat founders asking not “can I start this?” but “should I?” That’s the whole game.

Incorporating and raising capital is a minimum three-year commitment (even if you realize you’re wrong on day one). When you factor in the salary and options you’re leaving behind, the opportunity cost is massive. The market is shifting: the best founders are moving slower, not faster.

Takeaways:

Narrative-driven valuations are temporary; real cash flow is permanent.

The most important founder question isn’t “can I?”—it’s “should I?”

Opportunity cost is real, especially for experienced operators.

Slow conviction beats fast momentum.

If you’re not pressure-testing your assumptions before you commit, you’re risking years of your life on a story that might not hold up.

Asks:

If this resonates—if you or someone you know is in that “should I?” phase—apply here.