Welcome to Slow Ventures’ Snailmail, where we unpack what’s on our partner’s and founder’s mind every Sunday.

TL;DR:

Not All Pivots Are Created Equal

Yoni Rechtman

Context:

Let’s talk about pivots. They really suck for founders. There’s a lot of pressure in startup land to “make it work” even when it’s clearly not working. I don’t want to see people burning cycles and money just to say they tried every permutation of a dead idea. That said, early-stage companies are basically bets on people and a general direction, not a fixed plan. Everything else is, by nature, up for grabs and experimentation. So the real question is: what kind of pivot is worth doing?

Market Signal:

You’ll see two main types of pivots in the wild:

Type 1: Changing the angle of approach while staying committed to a core vision. This is the messy, iterative, early-stage experimentation that actually builds great companies. You’re still aiming for the same North Star, just finding a better way to get there.

Type 2: Changing the destination entirely—new market, new product, new everything. This is basically starting over, but with less money and less time. Almost never works. When I see companies try this, it’s usually a Hail Mary that doesn’t pan out.

Takeaways:

Type 1 pivots are not only normal—they’re necessary. If you’re iterating on how to reach your vision, keep going. This is the good stuff.

Type 2 pivots are a red flag. If you’re fundamentally changing what you’re building and why, you’re probably better off winding down and starting fresh.

Conviction and speed matter. Here’s a pattern I’ve noticed: when founders ask me whether they should pivot, those pivots usually fail. When founders tell me they’ve made a decision, those pivots usually work. It’s about conviction and speed of execution, not seeking permission.

My First Investor Was My Wife—And Why That Matters More Than You Think

Wen Sang (Slow Alum)

Context:

When people ask who my first investor was, I tell them the truth: it was my wife. Before there was a pitch deck, a market, or even a product—she wrote the check that mattered most. Not because of the money, but because of the permission and belief it represented. That’s the emotional capital every founder needs before the financial capital shows up.

Ten years ago, I was a fresh PhD grad on stage at the MIT Global Founder Skills Accelerator. My plan was naive, my energy was off the charts, and most investors just smiled politely and moved on. But Sam at Slow Ventures didn’t. He bet on me, not the pitch. He wrote that first check for Smarking and backed me through every near-death moment—not just with capital, but with real support when things got tough.

That’s the bond that matters in startups: trust built in the trenches, not just contracts.

Today, as Co-Founder and COO of Genspark.ai, I’m building with a team that’s scaled products to billions of users and weathered every kind of storm. Our Super Agent suite, launched in April 2025, is redefining what AI agents can do for knowledge workers worldwide. We’ve gone from zero to $50M ARR in five months, raised $435M, and processed over a trillion tokens with OpenAI.

But none of that would have happened without the scar tissue, the experience, and the people who believed in me when there was no reason to.

Market Signal

The market is hungry for real, battle-tested teams who know how to build at scale—not just pitch decks and hype cycles. Genspark’s explosive growth—$50M ARR in 5 months, unicorn status, and strategic partnerships with OpenAI, Anthropic, Microsoft, and AWS—signals that the next wave of tech winners will be those who combine deep technical expertise with true operator experience.

Investors and founders alike are waking up to the fact that the best outcomes come from teams who have failed, pivoted, shipped, and survived before. The market is rewarding substance over sizzle.

Takeaways

The first check is emotional, not financial. It’s about belief before evidence.

The best investors stand by you through hell, not just the highlight reel.

Teams that win at scale have the scars to prove it—they’ve built, broken, and rebuilt before.

Genspark’s success is a decade in the making, built on hard-won lessons and deep trust.

Real innovation comes from real experience, not from chasing the latest trend.

Asks

If you’re a founder: Find investors who will back you through the darkest moments, not just the demo day.

If you’re an investor: Bet on grit, not just the pitch. Be the kind of partner who gives founders the space to take care of their teams and themselves.

If you’re a knowledge worker or operator: Try Genspark.ai. We’re offering 1,000 free credits to the Slow community—experience what a decade of battle scars can build. Click here to claim.

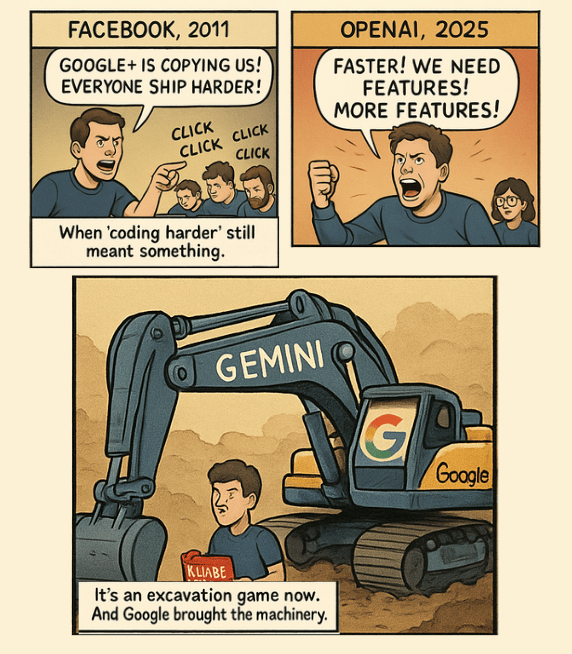

Why OpenAI’s “Code Red” Isn’t Facebook’s 2011 Google+ Lockdown

Sam Lessin

Context:

I can’t help but get déjà vu watching OpenAI’s “code red” response to Google Gemini. Fourteen years ago, I was in the only Facebook engineering building when Google+ launched. It truly felt like a sneak attack from a massive, well-resourced competitor. Google+ was polished, fast, and—at least on the surface—scary. Facebook’s response was a full-on lockdown: Mark rallied the troops, people pulled all-nighters, and there was this intoxicating sense of urgency, like we were at war. It was a blast. But here’s the thing: despite all the noise, Google+ turned out to be a nothing burger. Google copied the features but missed the magic of making social actually work. The only lasting impact? “Login with Google” gave them a real wedge, but otherwise, Facebook won.

Market Signal:

Fast forward to now—2025. A lot of us who lived through those Facebook/Google+ wars are now in leadership at OpenAI, itching for another round of that adrenaline-fueled hypergrowth. I get it. Once you’ve felt that energy, you want it again. But here’s where I think the analogy breaks down: OpenAI’s “code red” isn’t Facebook’s Google+ lockdown. This is a much more existential moment for OpenAI.

Takeaways:

The crucial difference? Google isn’t entering unfamiliar territory this time. With Gemini, they’re reclaiming ground they arguably owned all along. Google has the distribution, technical talent, data, brand, ad platform, and even hardware. This isn’t a moonshot—it’s a homecoming. Sam (Altman) is a visionary and a world-class marketer, but with the hand he’s holding, I don’t see how a “code red” for ChatGPT changes the game. Even if OpenAI ships a better product for a minute, Google can and will catch up. Unless there’s some wild, game-changing trick (which I can’t even imagine right now), incremental features or harder/faster shipping just don’t matter in this landscape.

And, ironically, that’s the story of AI itself: it reduces the leverage of human capital. In the age of steam shovels, it doesn’t matter if you have a digger who can dig a little faster. In the age of AI, having a team of brilliant engineers who can “code harder” in a crisis just isn’t the difference-maker it used to be.

Asks:

Don’t get caught up in nostalgia for the old playbook. The terrain has changed.

What actually moves the needle in an AI-native world?

Where are the new defensible moats?

And if you’re at OpenAI or a similar company, what’s your real edge when your opponent owns the distribution, the data, and the platform?

More Musing From The Team