Welcome to Slow Ventures’ Snailmail, where we unpack what’s on our partners’ minds every Sunday. This week’s edition is supported by our PortCo: MemeLord.com who’s currently having a 52% Off Black Friday Sale. Check them out and enjoy the meme’s!

TL;DR:

They’re Not Dumb. You’re Just Not Paying Attention.

Sam Lessin

Context:

Here’s the thing I keep seeing: people throw around the word “stupid” way too easily, especially in business. But in my experience, most people aren’t dumb. In fact, they’re usually pretty sharp. When you see someone doing something that looks idiotic or irrational, I’d bet 80-90% of the time it’s not because they’re clueless. It’s because you don’t fully understand their incentives, their worldview, or the context they’re operating in.

Market Signal:

This is especially true in early-stage VC, where the real job is less about analyzing markets or products and more about deeply grokking the teams. The best investors aren’t just spreadsheet jockeys, they’re empathy machines. They’re constantly trying to reverse-engineer the other person’s model of the world and the incentives that drive their decisions. If you can do that, you’ll actually understand why people do what they do, sometimes even better than they do themselves.

Takeaways:

If you catch yourself thinking “this founder is just dumb,” pause. Maybe you’re missing something.

Your job (especially in VC, but really in any business interaction) is to do the work: understand the other person’s worldview and what they’re optimizing for.

This requires real context and real empathy. You need to put yourself in their shoes, with their beliefs, not yours.

If you’re not willing to do that work, you’re probably just being intellectually lazy.

Seed VCs, in particular, are basically unlicensed therapists for people with a very specific entrepreneurial “delusion.” Our job is to analyze those delusions, understand the underlying incentives, and then decide whether to back them (and share in the upside).

Stop Chasing Hot Rounds, Earn Your Conviction First

Will Quist

Context:

Let’s be honest: valuations are fickle. They rise and fall with whatever narrative is hot that quarter. What doesn’t change? Actual, durable net income.

If you can get yourself to a place where you’re convinced your company can do a few hundred million in net income (or free cash flow, pick your poison), you’ll be fine. I’m not joking, this is a critical exercise for experienced founders, and it’s one that’s too often skipped.

Market Signal:

There’s a lot of noise in the market right now—hot rounds, frothy multiples, “move fast” energy everywhere. But the real signal? The founders who take their time, develop deep conviction, and only then commit. We’re seeing more experienced operators and repeat founders asking not “can I start this?” but “should I?” That’s the whole game.

Incorporating and raising capital is a minimum three-year commitment (even if you realize you’re wrong on day one). When you factor in the salary and options you’re leaving behind, the opportunity cost is massive. The market is shifting: the best founders are moving slower, not faster.

Takeaways:

Narrative-driven valuations are temporary; real cash flow is permanent.

The most important founder question isn’t “can I?”—it’s “should I?”

Opportunity cost is real, especially for experienced operators.

Slow conviction beats fast momentum.

If you’re not pressure-testing your assumptions before you commit, you’re risking years of your life on a story that might not hold up.

Asks:

If this resonates—if you or someone you know is in that “should I?” phase—apply here.

Startups Are Just Stories of The Future

Yoni Rechtman

Context:

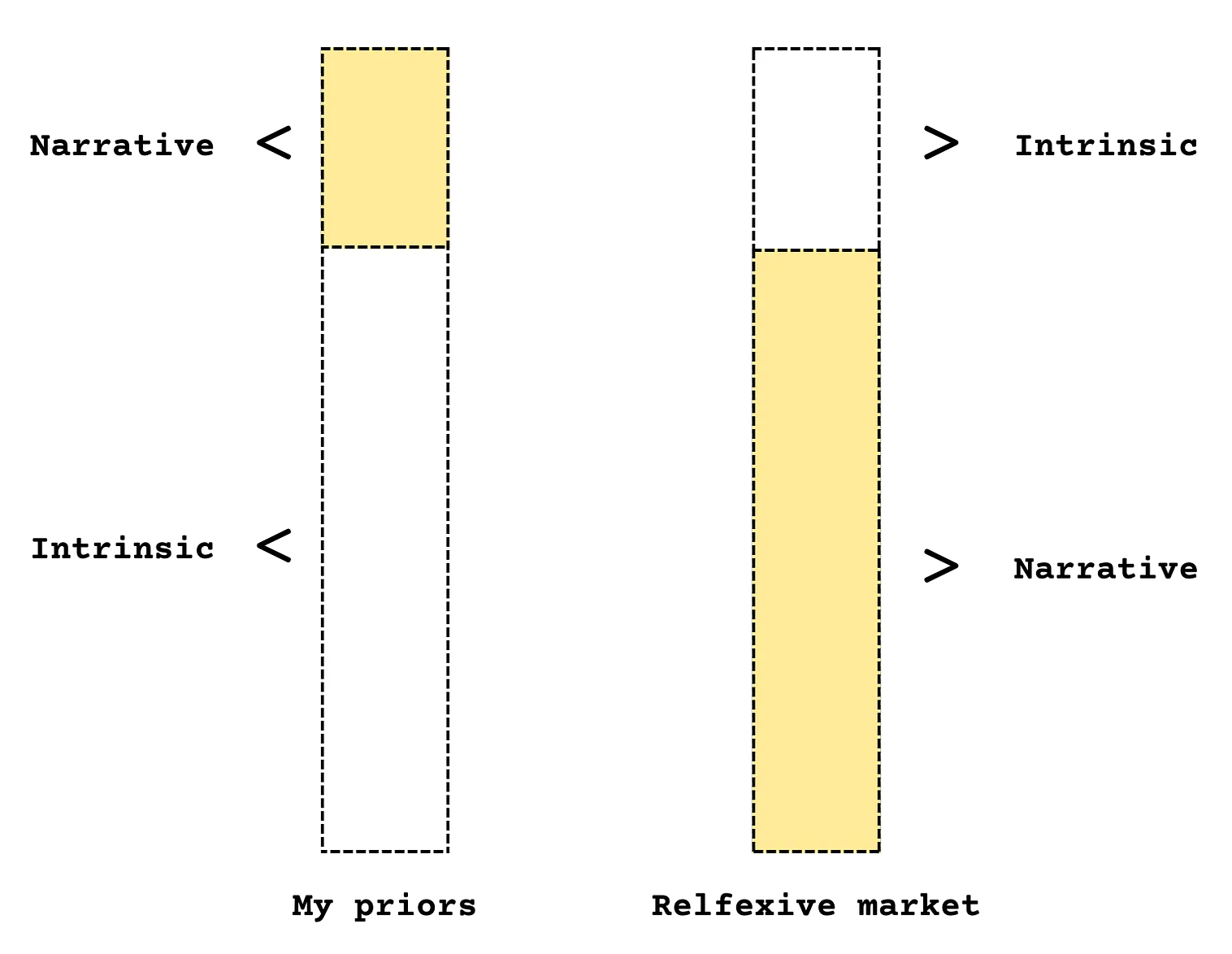

Last week, we returned to a theme that keeps proving itself more essential every cycle: the criticality of good storytelling and the power of narrative in startups. I used to believe that the “real” drivers of a company: product, traction, team, numbers, were 75% of the story, and narrative was just the packaging. But looking back, I had it backwards (or worse): narrative is everything.

Startups, at their core, are stories about the future.

Market Signal:

The market doesn’t just reward the best products or the biggest revenue. It rewards the companies that convince us they’re inevitable. Markets are reflexive: the winners win because everyone believes they’re going to win. Valuation chases narrative, not the other way around.

Takeaways:

Narrative is not a garnish; it’s the main course. If you’re treating your company’s story as an afterthought, you’re already behind.

Don’t confuse internal milestones for outward narrative. ARR, fundraising, and markups are table stakes. The real narrative is about how the world changes if (when) you win—and what’s at stake if you don’t.

Vision > Hype. Hype is just noise about your last round. Narrative is the weight of your vision and the consequences of your mission.

It all “rounds to zero.” Whether you’ve got $10k or $10M in revenue, you’re still at the foot of the mountain. What matters is the proof you’re putting up toward something bigger than yourself.

More Musing From The Team